- Home

-

Who we help

- UK Business & Entrepreneurs

- UK Companies expanding globally

- International groups expanding into the UK

- Charities

- Creative Industries

- Fashion & Beauty

- Family Businesses

- Globally Wealthy Individuals

- Individuals & Families

- Leisure & Hospitality

- Private Finance Initiative

- Professional Practices

- Property & Construction

- Property Developers

- Property Investors

- Social Businesses

- Student Unions

-

Services

- Audit

- Benchmarking

- Business Advice

- Business Performance Improvement

- Business Tax

-

Personal Tax Planning

- Domicile & Residence Planning

- Expert Witness for Matrimonial Disputes

- Family Investment Company

- Inheritance Tax Planning

- Internationally Mobile Individuals

- Personal Tax Investigations

- Retirement Planning

- Offshore Structuring

- Succession Planning

- Self Assessment Tax Return Service

- Tax on Residential Property

- Trusts

- Support & Accounting

- About

- Insights

- Careers

- Contact

- Search

-

Who we help

Who we help

We help organisations and their owners and directors.

The organisations are UK based as well as international groups looking to invest into the UK. They tend to be established and growing entities.

We love working with clients across a broad range of sectors but have particular expertise in the areas listed.

We also work with private individuals and families with their own personal tax matters, whether their wealth is UK-based or international.

-

Services

Our services

Goodman Jones are not just Chartered Accountants and Auditors – but advisers who are passionate about providing an outstanding tailored service to each of our clients.

Our range of services are our response to listening to what our clients value.

-

About

About us

We are not just Chartered Accountants and Auditors – but business advisers who are passionate about providing an outstanding tailored service to each of our clients.

-

Insights

Our Insights

We share insights regularly on issues and topics that affect our clients. Find out what our people think...

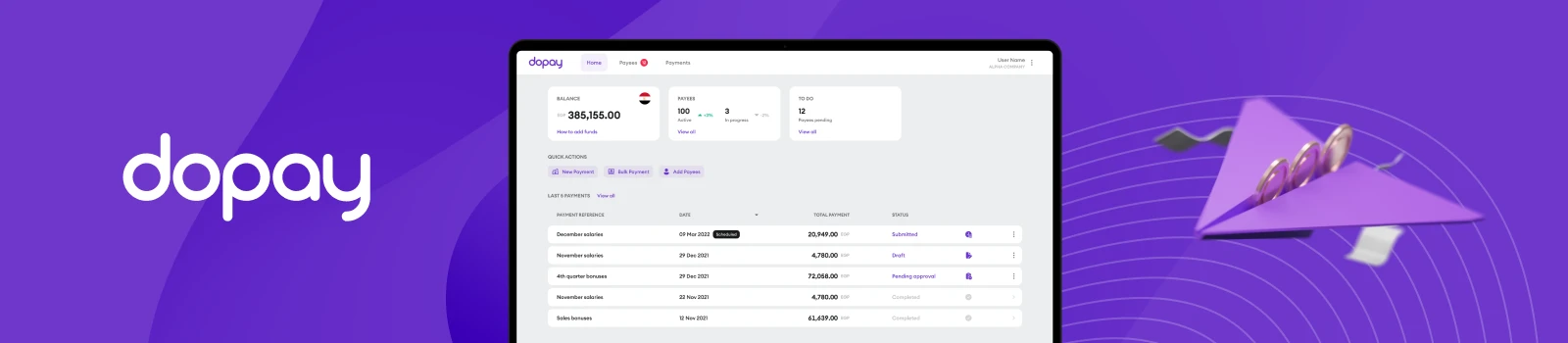

Client Profile: dopay

Improving business performance with financial decision making

Goodman Jones + Dopay + Twinfield

Combining technology with an understanding of international businesses to provide financial reporting and analysis to make better business decisions.

In tomorrow’s economies, being paid into an account is the new norm. But what if your employees don’t have an account?

There are two billion people that have jobs, but no bank account. In a country like Egypt for instance, only 3% of the adults get their salary paid in an account. With dopay all your workers can be paid electronically, while empowering them with access to financial services at the same time.

dopay’s mission is to become the ‘day-to-day’ bank in markets with largely unbanked and financially underserved populations. They provide a cloud-based payroll service that allows employers to calculate salaries and pay all employees electronically. Unbanked employees receive their salary in a dopay account, which comes with a debit card. Employees can manage their ‘day-to-day’ finance with the dopay app, which gives them instant and real-time access to their balance. It also lets users top-up their prepaid mobile and send money, anywhere anytime.

The Challenge

dopay is based in the financial heart of London. It has grown rapidly and now has operations in the Netherlands, Ghana and Egypt.

For a fast moving, entrepreneurial organisation, the ability to take decisions based on up-to -date financial information is critical.

dopay needed their financial information presented in a consolidated form to show the group accounts as if it were a single entity.

The financial information from each subsidiary needed to be converted into a single reporting currency.

Each subsidiary had its own local accounting methods – checks, updates and corrections were time consuming and slow to deal with – especially with multiple time zones.

How we helped

A powerful and cost effective approach was required that was easy to implement across multiple locations.

On identifying the system Philip Woodgate, Goodman Jones partner said, “We sat down with dopay to look at the needs and future need of the business. Together we quickly decided that Twinfield was the best system to overcome the dual currency issues and provided the speed and efficiencies of a cloud-based solution.”

Once the system was identified dopay and Goodman Jones collaborated together to implement the system, train the users and produce group accounts.

How dopay has benefitted

The end result, monthly group financial information prepared efficiently, easily and cost effectively – with full drill down transparency to each individual transaction and the supporting invoice – all online.

Khaled Abou-Zied, of dopay said,

The results are excellent. We finally have a much better understanding of our business. We can analyse our figures and can quickly identify the areas of growth. We can look at group accounts but also have the ability to immediately drill down to a specific invoice in Ghana if we need to.

Goodman Jones not only understood the technology but by tapping into their understanding of international businesses we now have financial reporting that is clear, fast and accurate and sets us up for future growth.

-

Who we help

- UK Business & Entrepreneurs

- UK Companies expanding globally

- International groups expanding into the UK

- Charities

- Creative Industries

- Fashion & Beauty

- Family Businesses

- Globally Wealthy Individuals

- Individuals & Families

- Leisure & Hospitality

- Private Finance Initiative

- Professional Practices

- Property & Construction

- Property Developers

- Property Investors

- Social Businesses

- Student Unions