The Bio-diversity Net Gain (BNG) requirement means that any habitat lost by a development must be replaced with enhanced habitat such that the improvement in habitat scores at least 110% of the value of the habitat that is being lost.

When does this apply?

The new Bio-diversity Net Gain requirements had been expected to become mandatory this November for planning applications for larger sites in England. However, an announcement at the end of September has deferred the implementation to 2024, meaning it could coincide with the original deadline for smaller sites.

Will it still go ahead?

A spokesperson for the government confirmed that it is fully committed to biodiversity net gain which will have benefits for people and nature. We will set out more details on implementation timings shortly. They added that more than £15m has already been committed to help local councils recruit the specialists they will need to deliver the new rules.

How will it be calculated?

In short, it’s not straightforward. Biodiversity Metric 4.0 is a biodiversity accounting tool that can be used for the purposes of calculating biodiversity net gain and assess the value of a project. However the guidance notes (published on Natural England’s Access to Evidence website) run to nearly 70 pages indicating that developers should build in time to familiarise their teams and properly appraise sites under the forthcoming rules.

There is some support for smaller sites, with the introduction of a simplified calculation called the “Small Sites Metric”. Small sites are considered to be those less than one hectare and fewer than 10 houses, or smaller than half a hectare if the number of units is yet to be determined. The Small Sites Metric guidance notes run to 55 pages.

Given the level of understanding that developers and land buyers have to learn in order to be able to properly appraise development costs and the appropriate purchase price for sites, we do hope that the delay will be used to bring in greater clarity. Particularly as The House Builders’ Federation had previously criticised the guidance for containing ‘significant gaps’.

Costs

Unless the additional costs are factored into the residual value of site acquisitions, it is likely that costs will fall to the developer. This is particularly the case for land that has already been acquired in whole or which is under option. Hence, there is some urgency by which developers need to ensure that those costs are factored into their financial modelling.

In short, the biodiversity condition of each site will have to appraised as a starting point. The developer then needs to assess how the biodiversity lost is returned. This can take one of three forms, depending upon the specific details – replacement of habitat elsewhere on site, replacement off-site and acquisition of BNG credits.

Whilst the deliberately inflated costs of BNG credits are unlikely to be reality for most sites, there will still be costs for on-site and off-site locations to reach the 110% requirement.

Longer term implications

The BNG and maintenance would have potentially long term implications if there is a requirement for ongoing intervention to maintain their condition. This could have further valuation and accounting implications, including the need to introduce provisions that cover periods long after sales have completed. Not only can this affect the availability of future capital, but extends to changes in estate management services and the costs associated with that.

Value of land

As mentioned above, increased BNG costs for certain classifications of land, could mean that developers see the value of land banks and sites for purchase, shift in value.

For those sites where there is not enough on-site space to meet the requirements, developers will need to secure land off-site. However, Natural England’s Biodiversity Gain Site Register is not yet open and it will take time before there is a balanced supply to demand. This naturally plays into the hands of free market economics and could see short term spikes that create unfeasible situations for some.

And of course, the opposite is also true. For landowners including developers with landbanks of attractive land, this of course represents opportunity.

In summary

There is a bit of respite, but there will be additional costs and complexity for housebuilders to absorb into their business model. Finance teams should look to this period to get to grips with the likely costs and ensure that there is a joined up approach with buying / promoter teams because there could be a significant shift away from traditional site valuation models.

The information in this article was correct at the date it was first published.

However it is of a generic nature and cannot constitute advice. Specific advice should be sought before any action taken.

If you would like to discuss how this applies to you, we would be delighted to talk to you. Please make contact with the author on the details shown below.

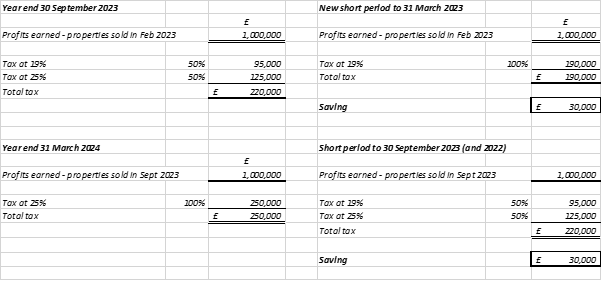

The property sector is facing many challenging pressures including supply chain issues and rising fuel costs. However, there will also be the impact of taxation to factor in. The change in government has added new uncertainties so it is important to make sure to stay alert to the tax issues.

The property sector is facing many challenging pressures including supply chain issues and rising fuel costs. However, there will also be the impact of taxation to factor in. The change in government has added new uncertainties so it is important to make sure to stay alert to the tax issues.

We are delighted to welcome Figen Davies to the firm in the role as Practice Manager.

We are delighted to welcome Figen Davies to the firm in the role as Practice Manager.