Many construction business owners are missing out on valuable tax breaks because they are under the misapprehension that Research & Development (R&D) tax relief only applies to those conducting formal research, such as pharmaceutical companies.

Any construction company undertaking some form of innovation may qualify for R&D relief. This is much more common than is often thought, with construction companies often coming across a problem and developing a new or unique solution to overcome it. If you have an employee who is a problem solver, for example, one would expect to have a claim and the cost of an employee can be considerable.

Is it worth it?

If you are an SME (Small and Medium-sized Enterprise – fewer than 500 employees and either turnover of up to €100m, or gross assets of up to €86m) you benefit from an enhanced rate of R&D relief. A profit-making SME can claim an additional deduction of 130 per cent of the R&D spend.

For year ending 31 March 2016 – the effective tax saving is 26% of R&D spend

There are separate rules for larger companies. They are restricted to claiming an additional deduction of 30 per cent of the R&D spend.

For year ending 31 March 2016 – the effective tax saving is 6% of R&D spend

What if we’re not making a profit?

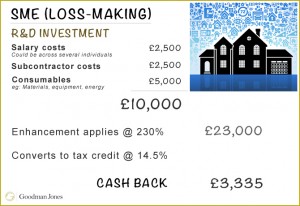

Even loss-making companies may be able to access cash back, which will be particularly welcome by start-ups or those needing cash to fund development.

SMEs can convert 230 per cent of R&D spend into tax credits at a rate of 14.5 per cent and receive cash.

For year ending 31 March 2016 – the effective tax saving is up to 33.35% of R&D spend

For a large company using the R&D Expenditure Credit scheme, a taxable receipt of 11 per cent of the R&D spend is granted.

For year ending 31 March 2016 – the effective tax saving is up to 8.80% of R&D spend

Red tape?

There are time restrictions, so businesses should not delay in finding out whether they might qualify for R&D relief.

Claims must be made within two years of the end of an accounting period but it is possible to go back and amend a tax return to include a claim. So if you submitted a tax return for the year ended 31 December 2014, you have until 31 December 2016 to go back and make a claim.

The claim is a relatively straightforward process, involving explaining what you did in writing and putting the costs against it before the claim figures are included in the computations.

Well worth it

We have guided a number of our clients in the property and construction sector through this and we were all delighted when we saw how quickly HMRC accepted the claims and in certain instances repaid substantial amounts of tax.

The information in this article was correct at the date it was first published.

However it is of a generic nature and cannot constitute advice. Specific advice should be sought before any action taken.

If you would like to discuss how this applies to you, we would be delighted to talk to you. Please make contact with the author on the details shown below.