One key area that is often overlooked when budgeting and forecasting is scenario planning (or ‘what if?’ analysis) but this has never been more important.

Budgeting is a vital financial management tool: it allows you to track how much has been spent against planned expenditure, it can help to identify potential future issues such as crunch points on cash flow, and it also helps with longer-term planning through forecasting future cash and reserves levels.

The importance of budgeting is heightened in current times, where circumstances are changing on what seems to be a daily basis.

One of the difficulties in making plans, budgets, and strategies at present is the level of change and uncertainty (although after Brexit and now COVID-19, perhaps uncertainty is the ‘new normal’) and so there is a greater need for charities to be nimble and flexible.

Scenario planning

Better financial information allows better decision making, and it is therefore important that the decision makers have relevant and accurate information when making those decisions.

Scenario planning allows organisations to make flexible medium and longer-term plans. It allows the Board and senior management to make more informed decisions that are based on an assessment of many and varied situations.

So what is scenario planning? It is making assumptions about the future and seeing what impact these will have on the future of your organisation, what it does, and how it does it.

Tips on the how to do this

If you have never done scenario planning before, this may seem daunting – particularly as it involves making assumptions in a rapidly moving environment. However, the process does not have to be over-complicated:

Firstly, be clear about the uncertainties you are planning for. Start broad (for example income levels or demand for services) and then narrow down (so if we take the income level uncertainty are you considering the loss of a particular funder, a general decrease in public donations, or a fall in commercial trading income?)

It’s important to consider all uncertainties – but assess likelihood and impact of each. I find that this initial stage works well alongside a review of your risk register – you want to make sure that you are factoring in those uncertainties that are most likely and/or carry greater impact. It is these critical uncertainties that you should plan for.

For each critical uncertainty, consider several different scenarios – there’s no right answer for how many to consider, and it will depend on what your charity does and how it is funded. Too many different scenarios for each uncertainty and the analysis may become too unwieldy; too few and you may not be covering every significant possibility.

This stage is where we start to narrow down the uncertainty. Let’s say the critical uncertainty is loss of commercial trading income from a cafe – consider different scenarios such as no trading income for the rest of the current financial year, different levels of capacity, or even wider issues (such as future levels of tourism).

Review and discuss the implications and impact of each scenario. Involve individuals from throughout the organisation – heads of department / project managers or even volunteers may have a clearer idea of different scenarios or impact.

Some final tips

Of course, all of this depends on a strong foundation of accurate and up to date accounting records and financial information. If the accounting records are not maintained regularly, monitoring performance against budget will be less effective and future planning may be impacted as cash and reserve levels are unknown.

Try not to fall into the trap of considering too many uncertainties and too many scenarios for each uncertainty – keep it simple and focused. But remember that there may be various scenarios to model. Scenario planning should not be built around a single factor.

Consider short, medium, and longer-term scenarios – the impact and outcomes may change over time so factor this into your assumptions and into the modelling.

Try to incorporate the scenarios into the modelling so they can be flexed easily – for example, use an Excel model that uses Excel formulae so that as few cells as possible have to be updated.

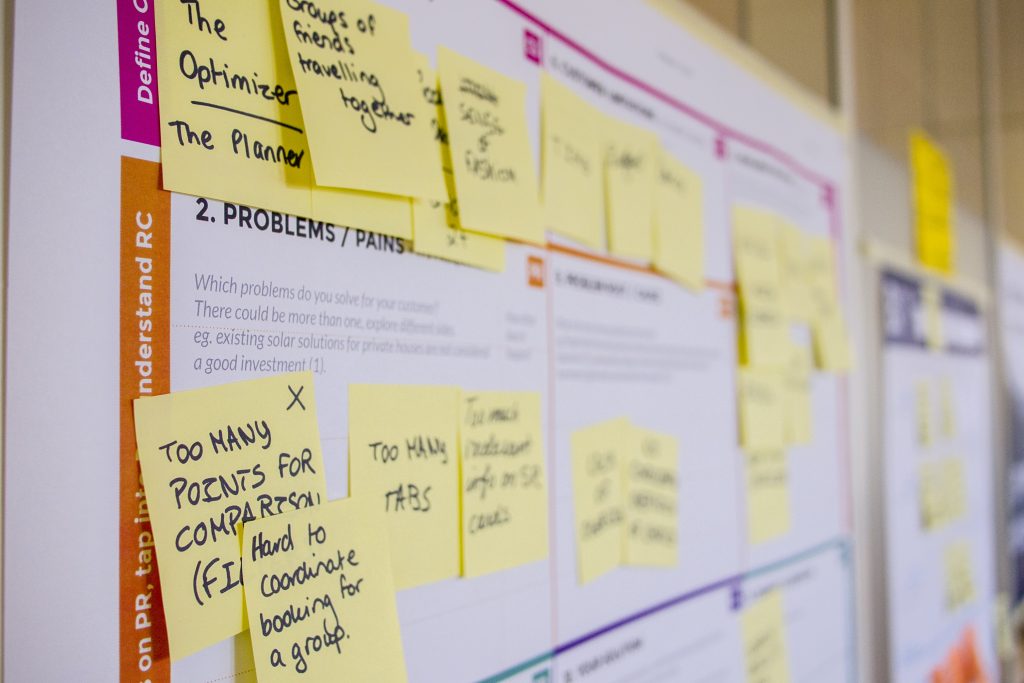

Photo by Daria Nepriakhina on Unsplash

The information in this article was correct at the date it was first published.

However it is of a generic nature and cannot constitute advice. Specific advice should be sought before any action taken.

If you would like to discuss how this applies to you, we would be delighted to talk to you. Please make contact with the author on the details shown below.