Many people have taken advantage recently of the special arrangements to pay their self assessment tax by instalments. With a lot of talk in the papers about the prospect of deflation, should those people be worrying about the negative impact deflation will have on there overall debt?

The January reduction in interest rates for late paid tax from 4.5% to 3.5% certainly came at a very good time for anyone owing tax, but if deflation is going to increase the value of the debt, will the actual effective interest rate be much higher?

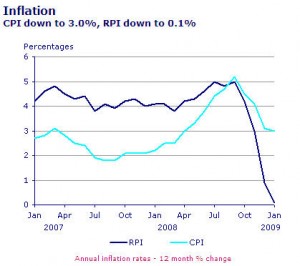

The chart above taken from the National Statistics web site does show a dramatic decline in RPI to only 0.1%, which has no doubt helped fuel the concern over the prospect of deflation, but other indicators suggest that talk of deflation may actually be misplaced. The CPI figure also shown on the same chart, whilst undeniably declining, is still at 3.1% which is above the government’s long term target inflation rate of 2%. Furthermore, if you read the National Statistics small print, the largest downward pressure on both indices is the reduction in fuel costs which have been on a rollercoaster ride over the past year. Surprisingly, no mention is made of the effect of the reduction in VAT by 2.5%, which could apparently account for 1% of the drop. If so, then adjusting for the VAT effect would keep the CPI figure above 4%.

Many of the current economic pressures are actually inflationary rather than deflationary. A low pound, high government borrowing and spending and “quantitative easing” (a polite term for printing lots of paper money) are all inflationary.

So rather than the prospect of deflation, are we in fact facing the more familiar problem of inflation? Inflation with low interest rates – perhaps it is not such a bad time to owe the government money!

The information in this article was correct at the date it was first published.

However it is of a generic nature and cannot constitute advice. Specific advice should be sought before any action taken.

If you would like to discuss how this applies to you, we would be delighted to talk to you. Please make contact with the author on the details shown below.