The HMRC Tax Administration consultation document is consulting on four areas:

- Compliance

- Late submission penalties

- Late payment sanctions

- Interest

This consultation does not include other aspects of tax administration. Changes to inaccuracy penalties will be covered in subsequent consultations. There is no proposal to introduce a power to enable HMRC to enquire in-year into regular updates, nor increase the overall number of compliance interventions as a result of these updates.

Compliance

There will be a new obligation for certain customers to keep records digitally on software that links to and updates HMRC. Existing record keeping legislation will need to be modified to reflect those proposals.

HMRC want a new power to enquire into the regular updates and check any of the information that is included in a customer’s End of Year declaration and is used to calculate their tax. The customer’s digital records may form part of any enquiry.

HMRC propose a power to make determinations of End of Year declaration as with Tax Returns.

They propose to replicate the power for HMRC to correct obvious errors made in the End of Year declaration.

In MTD business customers will need to provide regular updates. This consultation proposes a new way of addressing failures to provide regular updates and carry out the End of Year declaration.

Penalties

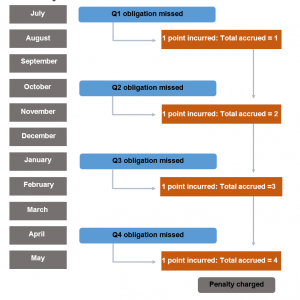

“Instead of applying penalties to each failure, we propose a much more gradual model whereby each failure would attract penalty points. Only once the points reach a set level would a penalty be charged.”

Once a penalty has been incurred, the customer would incur further penalties if they failed to meet their subsequent submission obligations. The points total would remain unchanged until such time as a sustained period of compliance caused it to be re-set to zero.

The points total would be re-set to zero after the customer has achieved 24 months of compliance with their submission obligations.

See Diagram 1 for an example of how points based penalty regime would work.

Diagram 1

HMRC propose 12 months as an appropriate length of time to allow customers to become familiar with the new obligations before the new penalty regime comes into effect.

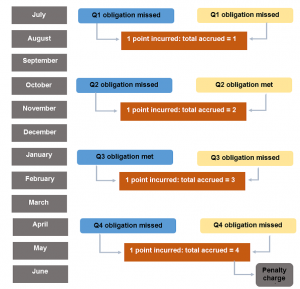

Many customers are subject to a number of separate obligations. For example, an individual in business and having employees would have to provide quarterly updates and finalise those updates after the end of the tax year for their own Income Tax purposes and regularly submit PAYE information about their employees via Real Time Information (RTI). In practical terms, all submissions due in the same calendar month would have to be treated as being due “at the same time”.

The government would explore options for taking account of the customer’s compliance history across all of the taxes they are involved with in developing a new late submission penalty.

See Diagram 2 for an example of how this would work.

Diagram 2

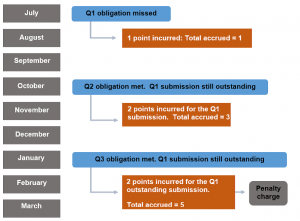

The basic points-based penalty would be unsuitable for occasional obligations (such as the filing of Inheritance Tax returns). In these cases it is unlikely that points incurred could act as a warning system to encourage a return to compliance.

An alternative to points based system is the Escalator Model – see Diagram 3

Diagram 3

The basic model is designed to be simple but it lacks an incentive for those who have missed making a particular submission to remedy that failure. One way to address this would be for customers to incur further points to reflect the fact that a submission was still outstanding. This would focus the customer’s attention on remedying what has already gone wrong as well as encouraging good compliance in the future.

The escalator model might be unsuitable for monthly obligations because points could accumulate very quickly and the customer might have insufficient time to heed and act upon the warning.

Late payment sanctions

There are two proposals which are:

A. The use of penalty interest to be charged on customers who fail to pay in full

within fourteen days of the due date, or who before that date have failed to enter into arrangements to pay over an agreed period to which they then adhere.

B. A revision of existing legislation to deliver an aligned penalty regime for income tax, VAT and corporation tax per Models 1 & 2

Model 1 – Introduce a model based on the Income Tax late payment penalty regime for each of the three taxes coming into scope of MTD.

Model 2 – Introduce a tapered system where the late penalty percentage rate increases the longer the debt remains outstanding. This would encourage customers to fulfil their payment obligations sooner, before a higher penalty rate is reached.

Late payment interest

HMRC propose to continue with the current rules for Income Tax and Class 4 NICs when MTD starts in April 2018.

Summary of consultation questions from HMRC

- Do you agree that compliance legislation should be amended to replicate current enquiry powers into the Self Assessment return to the End of Year declaration?

- Do you agree that current HMRC and customer safeguards should also be maintained?

- Are there any other options for preserving HMRC’s current enquiry powers in MTD?

- Do you agree with the proposed approach to replicate HMRC’s compliance powers for determinations, corrections, information powers and discovery assessments?

- Do you have any other comments on how compliance powers need to change to transition to MTD?

- Do you agree that 12 months is an appropriate length of time to allow customers to become familiar with the new obligations before the new penalty regime comes into effect?

- Do you agree that the period to wipe the slate clean should be 24 months? If not, what other period would be appropriate?

- We invite views on the design principles outlined for the points-based penalty. For example, do you consider there are any further elements to build in to this basic model?

- At what stage for each of these different submission frequencies should points generate a penalty?

- We would welcome comments on whether existing penalties are sufficient to support compliance with occasional filing obligations. If not, what more is needed?

- Do you agree that, in principle, a single points total that covers all of the customer’s submission obligations is the right approach?

- Do you agree that the points based proposal outlined in is the right way to operate a single points total? If not, what alternative would you suggest that ensures the design of the penalty is kept simple?

- We welcome views on whether the escalator model would be a more effective way of aligning with HMRC’s customer focused fairness based principles?

- Do you agree that a fixed amount penalty is appropriate?

- Should the amount of fixed penalty reflect the size of a business?

- Do you agree that points should only become appealable when they have caused a penalty to be charged?

- Do you agree that 14 days is an appropriate length of time to allow customers to either pay in full, or make arrangements to do so before penalty interest is charged?

- Do you think that charging penalty interest is the right sanction for noncompliance with payment obligations?

- Are there other commercial models that might be appropriate for us to consider?

- We invite views on the design principles outlined for penalty interest. For example, do you consider there are any further elements to build into this proposal?

- Does model 1 or model 2 best meet the government’s objective of providing a fair and proportionate response to late payment of tax?

- Do you agree that the timing of late payment penalties should change to reflect the frequency of payment due dates?

- We invite views on the design principles outlined for late payment sanctions. For example, do you consider there are any further elements to build into these proposals?

- Which proposal best meets the design principles?

- Should the current interest rules for Income Tax and Class 4 National Insurance contributions continue to apply in MTD?

- Do you have any initial comments about aligning interest rules across taxes?

- Please provide details of how the proposed administrative changes will affect you, including details of any one-off and ongoing costs or savings.

- Do these administration proposals have a significant or disproportionate impact on groups with legally protected characteristics, as recognised in the Equalities Act 2010?

What do you think?

We will be responding to HMRC’s consultation and making representations on our clients behalf so please let us have your views by emailing MTD@goodmanjones.com.

Other areas covered by the consultation

This is only one part of the consultation. See summaries of the other areas here.

The information in this article was correct at the date it was first published.

However it is of a generic nature and cannot constitute advice. Specific advice should be sought before any action taken.

If you would like to discuss how this applies to you, we would be delighted to talk to you. Please make contact with the author on the details shown below.